For example, fixed asset purchases https://www.bookstime.com/ may be so infrequent that there is no need for a specialty ledger to house these transactions, so they are instead recorded directly in the general ledger. Hence, to avoid these issues it’s recommended to maintain a posting reference column. When an entity transacts in a large number on daily basis it becomes a troublesome task then for the bookkeeper to ascertain whether the entries are posted in appropriate ledgers. Later on, tracking that transaction and correcting the same becomes a tedious and time-consuming job. Every transaction your business makes requires journal entries.

- It is very important for you to understand the debit and credit rules for each account type or you may not calculate the balance correctly.

- So, when it’s time to close, you create a new account called income summary and move the money there.

- However, in the case of the accounts receivable ledger account, there is no balance by February 12 since the full amount of the receivable was already collected.

- A General Ledger is a record that contains all the ledger accounts of a business.

- If you use accounting software or outsource your accounting, your journal entries may not be visible, but they’re being generated in the back end, ensuring your books are accurate and up to date.

- For example, Cash, an asset, is assigned an account number beginning with the number one 100, 1000, 10100.

Debits and credits in the context of double-entry accounting

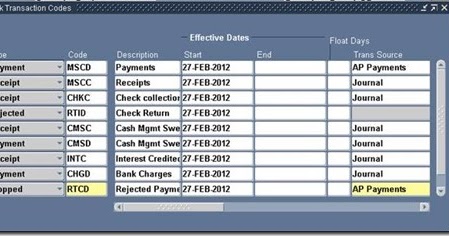

GJ5 indicates that the entry can be found on page 5 of the general journal.

- Equip yourself with the right tools and resources from our shop, or explore our free accounting lessons.

- A Ledger is a collection of accounts used to post journal transactions to individual accounts.

- My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

- Credits increase balance sheet liability accounts, shareholders’ equity accounts and sales accounts.

- The subsidiary ledger effectively eliminates the inclusion of nonessential information in the general ledger.

- An accounting software allows the simultaneous posting to the subsidiary ledger accounts and general ledger control accounts as transactions are recorded.

Adjusting journal entries

No more manually inputting recording transactions journal entries, thinking twice about categorizing a transaction, or scanning for missing information—someone else will do that all for you. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

What Does Post Reference (Post Ref) Mean in Accounting?

It refers to the transfer of closing balance from various accounts to the general ledger. The posting varies as per the size of the organization and the volume of transactions. The balance is directly transferred to a general ledger for small organizations because of the low volume of accounting transactions.

Outsourcing your accounting means you don’t have to worry about making journal entries

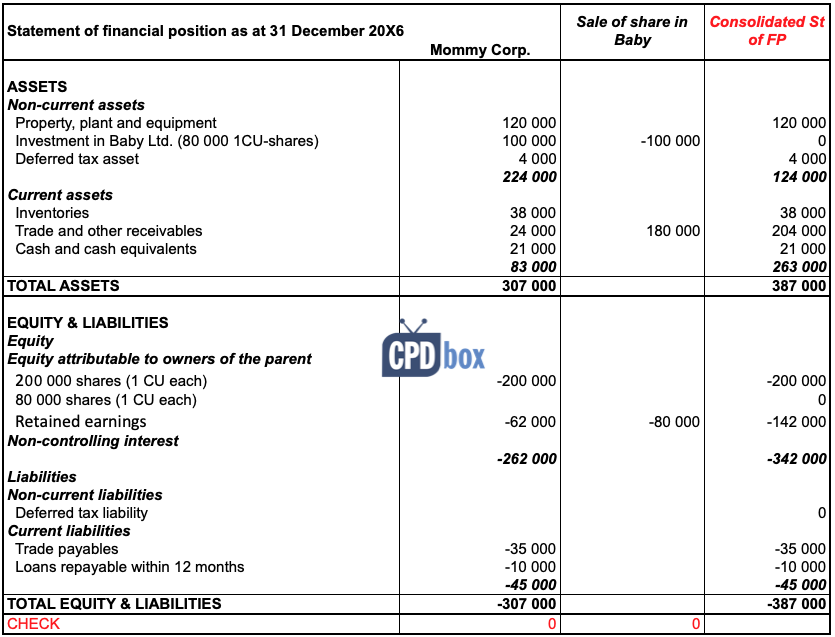

The total amount owed to you by these customers should equal the balance of the accounts receivable in your general ledger. Ledger Accounts are the individual account records that makeup the general ledger of your company. Each account is classified under assets, posting in accounting liabilities, equity, income, and expenses. The general journal contains entries that don’t fit into any of your special journals—such as income or expenses from interest.

Posting to the General Ledger

- You would promptly create a journal entry for that transaction, including the date, a brief description of the transaction (“November rent”) and any appropriate account information.

- The journal contains all journal entries that represent the recorded transactions.

- This happens when the debit or credit amount is made up of multiple lines.

- Think of “posting” as “summarizing”—the general ledger is simply a summary of all your journal entries.

It’s used to prepare financial statements like your income statement, balance sheet, and (depending on what type of accounting you use) cash flow statement. You would promptly create a journal entry for that transaction, including the date, a brief description of the transaction (“November rent”) and any appropriate account information. The $500 would count as a credit, or liability, in the Cash account, but would be a debit, or asset, in the Rent account. Both pieces of account information, debit and credit, would be included in the journal entry for that transaction. Similarly, if an account in a journal entry has been credited it will be posted to the ledger account by entering the same amount on the credit side/column of the respective ledger account. The fourth step is to calculate the running debit and credit balance for each account.